Travel Insurance Company Mississauga, ON

Get SOLID

Customer Service

Insurance Rates

Bundled Savings

Travel Safe with Customized Travel Insurance from Solidify Insurance in Mississauga

Whether you are planning to travel to another state or country, consider investing in travel insurance. A travel insurance policy protects you from potential losses that may result from travel delays or lost baggage. Some travel insurance policies reimburse policyholders for essentials in case of baggage delays.

If you are forced to cancel or delay your trip due to extreme weather or a sudden illness, your travel insurance policy may reimburse you for trip costs. Some travel insurance policies also cover emergency evacuations and medical emergencies. If you do not opt for travel insurance, you can get stuck in another country without any assistance, which can be a scary situation.

Solidify Insurance is a leading travel insurance company in Mississauga. We are known for our ability to create tailored travel insurance policies. Our flawless track record gives us a competitive edge over other Mississauga insurers. Regardless of the type and nature of travel insurance coverage required, we can create a travel insurance policy that ticks all the right boxes.

Solidify Insurance - Leading Travel Insurance Company in Mississauga

Below are some reasons why Mississauga residents buy travel insurance policies from us.

A Range of Affordable Insurance Plans to Choose From

Expensive travel insurance can lead to financial strain. We at Solidify Insurance strive to make travel insurance affordable so travelers need not dig deep into their pockets when buying a travel insurance policy.

Emergency Assistance

We are not your average travel insurance company in Mississauga. Our travel insurance policies include round the clock emergency travel assistance. If a travel emergency occurs, you will have access to a dedicated support network that can help you find a reliable healthcare provider (nearest to you). Depending on the coverage offered by your travel insurance policy, our team can arrange for emergency evacuation.

Flexibility

Some of our travel insurance policies offer Cancel for any reasons or CFAR coverage, allowing policyholders to cancel their trips if they have reasons to believe that an unforeseen event could derail their travel plans or they want to keep their plans flexible (so they can change them at the last minute).

Loyalty Benefits

We value loyalty. To show gratitude to our loyal customers, we offer loyalty benefits including reduced insurance premium and enhanced coverage to them. In some cases, we also offer additional services.

A Team of Experts

A business is only as good as its employees. We have built a team of knowledgeable insurance experts. Our professionals understand the nitty-gritty of different types of travel insurance coverage. They help our clients navigate the travel insurance landscape. Our travel insurance experts stay up-to-date with the latest insurance laws and regulations. They leverage their knowhow and experience to create value for our clients.

Our Promise

We are committed to offering affordable comprehensive travel insurance policies designed to meet a wide variety of travel insurance needs. We do not charge any hidden charges or fees ensuring travelers can buy travel insurance plans with confidence. We believe in maintaining price transparency and explain all costs to travelers before they buy travel insurance policies from us.

Explore Travel Insurance Offerings in Nearby Areas

Other Insurance Offerings in Mississauga

Mississauga Boat Insurance | Mississauga Business Insurance | Mississauga Car Insurance | Mississauga Commercial Property Insurance

Mississauga Condominium Insurance | Mississauga Cottage Insurance | Mississauga Home InsuranceMississauga Pet Insurance

Mississauga Rental Home Owners Insurance | Mississauga Rental Property Insurance | Mississauga Travel Insurance

Mississauga Under Construction Building Insurance | Mississauga Vehicle Insurance

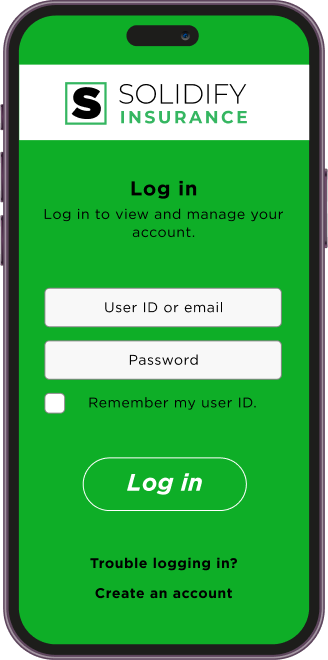

Solidify Insurance Mobile App

Instant insurance policy access 24/7

- Print your pink insurance cards

- Check your payments

- Update your policy

- Realtime access to policies

Get the App!

Get the App!

Frequently Askеd Quеstions (FAQs)

How do I choose the right travel insurance policy?

Choosing the right travel insurance policy involves several key considerations. First, assess your trip’s specifics, including the destination, duration, and activities you plan to engage in. Different destinations may have varying risks, so ensure the policy covers your chosen location. Next, evaluate your budget and the coverage options available. Review the coverage limits and deductibles to understand how much protection you need and how much you’re willing to pay out of pocket. It’s crucial to read and comprehend the policy’s terms and conditions, including any exclusions or limitations. Finally, select a policy that aligns with your specific needs, providing the coverage you require for a worry-free journey.

When should I purchase travel insurance?

The optimal time to purchase travel insurance is as soon as you book your trip. This early purchase ensures that you have coverage in place from the moment you make your initial travel arrangements. Importantly, it safeguards you against trip cancellations or interruptions due to unforeseen events that may occur before your departure. Waiting until the last minute to buy insurance may leave you exposed to risks that could have been covered had you purchased the policy earlier.

Is travel insurance mandatory for all travelers?

Travel insurance is not mandatory for all travelers, as requirements can vary by destination and travel provider. However, it is highly recommended for all travelers. Some countries may require proof of travel insurance as a condition of entry, especially for visitors on certain types of visas. Additionally, specific tour operators, cruise lines, or travel agencies may make travel insurance mandatory for participation in their trips to ensure the safety and well-being of all participants.

Can I cancel my travel insurance policy if my plans change?

Many travel insurance policies offer a “Free Look” period, typically within 10-15 days of purchase. During this time, you can review the policy in detail and, if you decide it doesn’t meet your needs, cancel it and receive a refund. However, this option is typically available only if you haven’t yet departed on your trip. After the Free Look period expires, cancellation and refund options may become limited, and you may only be able to make changes or additions to your policy.

Are there age limits for purchasing travel insurance?

Age limits for travel insurance can vary depending on the insurance provider and the specific policy. Some policies offer coverage without age restrictions, making them suitable for travelers of all ages. However, certain types of coverage, particularly those related to pre-existing medical conditions, may have a ge limits. It’s essential to review the policy terms and inquire with the insurer to understand any age-related limitations or options available for older travelers.

Areas We Serve

- Ajax

- Clarington

- Brock

- Halton Hills

- Milton

- Oakville

- King

- Markham

- Oshawa

- Pickering

- Scugog

- Brampton

- Caledon

- Mississauga

- Newmarket

- Richmond Hill

- Uxbridge

- Whitby

- Burlington

- Aurora

- East Gwillimbury

- Georgina

- Vaughan

- Toronto